Jason Calacanis Answers the Top 5 Questions He Gets about Angel Investing

In this guest Dreamit Dose, Jason Calacanis (@jason), a technology entrepreneur, angel investor, and the host of the popular podcasts This Week in Startups and Angel, answers the top 5 questions he gets about angel investing. When looking at angel investors vs. venture capitalists, there are a few differences regarding when to reach out to them and what motivates them to do deals. Jason, an experienced angel, gives his insight on what motivates angel investors, and how you can most effectively get an angel to be part of your team. You can watch the whole episode below:

What motivates angel investors?

It is very common for angel investors to be former founders who have already accumulated wealth. What motivates angels considering that they’re already financially secure? First off, most angels want to pay it forward. They want to share the knowledge they’ve gained from their own experiences. However, Jason mentions that status also plays a large role in motivating founders. Angels want to be affiliated with winning teams. They want to be part of your effort to change an industry. Like it or not, status plays a role for angel investors. However, don’t forget that most likely, angels you’re pitching to want to offer their best advice and be part of your journey to success and changing the landscape of an industry.

How do you attract angel investors?

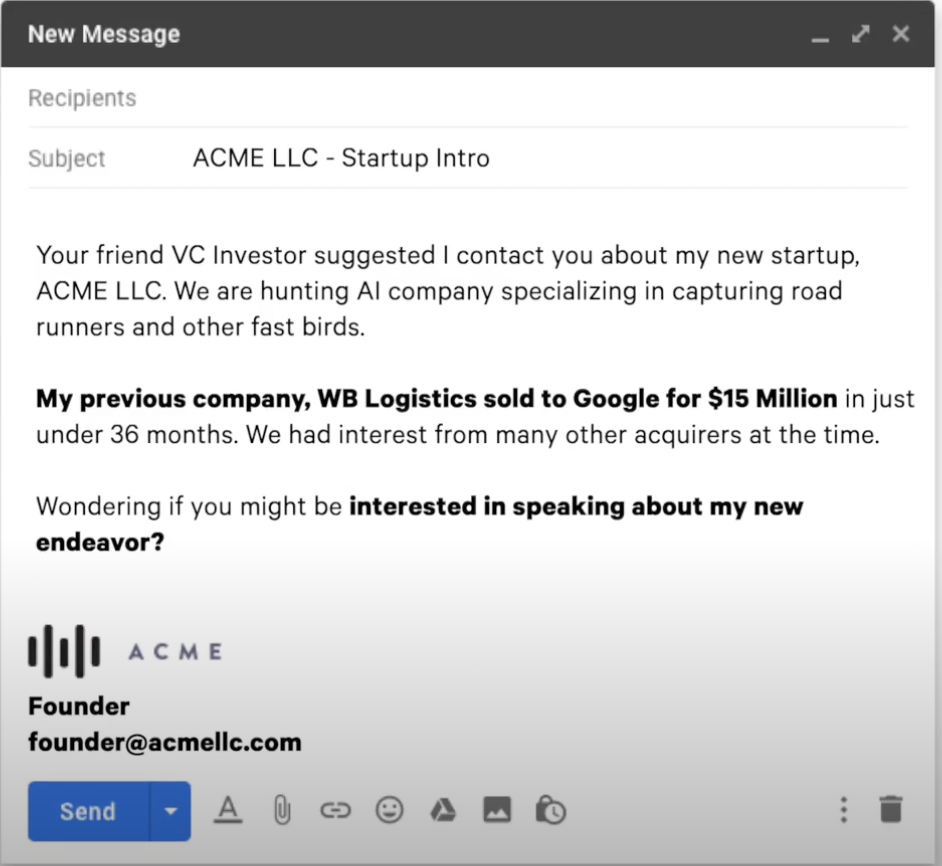

Angels want to be part of a successful team. How do you prove to angels that your team has the capability or is on the trajectory to become successful? If you’ve previously had success, then mention that when you reach out to investors. Here’s an example:

This will immediately build credibility and catch an angel’s attention. If you are not an experienced founder, but your company has already achieved growth then exhibit that in a chart. Jason recommends that you provide a chart that displays your company’s month to month growth. Consider showing your growth in users, then another chart that indicates the levels of revenue growth. Substantial growth, which Jason mentions could be around 20%, will appeal to any angel investor.

First startup and no prior success? Only contact angels with whom you have already built a reputation, and bootstrap until your product is ready for market. Then, go to angels once you have gotten a few customers.

90% of founders have not gotten their product to market. Avoid being in that bucket.

Why do angels do deals?

Angels do deals for a simple reason: They’re excited about your company. What excites an angel? Traction and determined entrepreneurs who are constantly working to make their company better. It is fairly self-explanatory. Jason advises that you should not base your strategy on outliers. For example, there are companies like Clubhouse that raised $10 million on an extremely high valuation, but it is not common knowledge that they were entrepreneurs in residence who were well-networked with VCs and created a bidding war over that deal. Do not compare your company. Work on growing your company to a point where you have proven success. Jason recommends taking a 1-year approach when it comes to angels. In that time, achieve significant milestones and have a timeline to show VCs that you’re growing. See the example below:

As you can see above, maybe it will take multiple offers for you to finally make a deal with an angel. If you’re showing significant milestones though, like getting into an accelerator to help you build your product, then bringing your product to market in the matter of a year, that will be attractive to an angel and lead to you making a deal down the road. Jason says, “Investing is about the long game.” Don’t lose sight of that.

How and when do angels make money?

Angels don’t expect to make money on the majority of their deals. According to Jason, they expect 80% of their deals to go to zero. How do angels make money on the other 20%? There are three ways:

There’s a secondary sale. When deals are made in the secondary market, an investor in the company sells their stake or position in said company to another investor.

The company gets acquired.

IPOs. Angels will sell their shares when a company goes public. SPACs (Special-Purpose Acquisition Company) are another way companies can go public.

When should a startup raise an angel round?

Those who have previously had success can go to angels at the ideation phase. However, others need to build credibility before approaching angels. Some founders are able to raise a round from friends and family. For those who aren’t able to, you can still build credibility by bootstrapping. Jason did not have the network to raise a friends & family round when he launched his first company. When Jason launched his magazine company in the 90s, he went to investors with just a photocopy of the magazine. What really matters is whether you wait or create at the earliest chance you get. You can bootstrap your way to creating a modest MVP, and that will instantly appeal to investors.

“Be part of the group that’s making not waiting.”

We hope we could answer your questions about angel investing. By following these tips, you increase your chances of appealing to an angel investor and get their first round of funding.

By Alana Hill, Securetech Associate at Dreamit Ventures

Book Office Hours with the Securetech team.