Venture Investment in Real Estate Tech Cools as Interest from Large Firms Heats Up

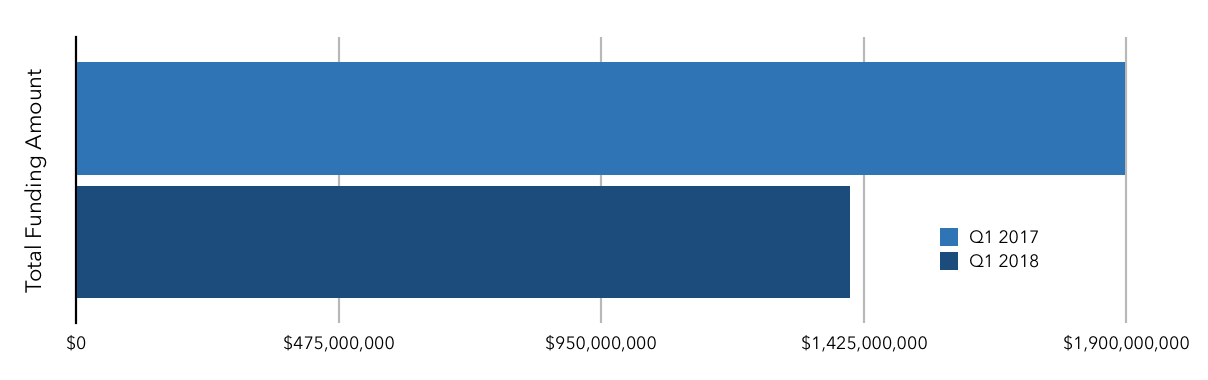

Total funding for real estate tech startups fell in the first quarter of 2018, compared to the same time span in 2017. The total funding to startups in Q1 of 2018 was approximately $1.4B, which represents a 75% drop from Q4 of 2017. This number does not necessarily mean a slowdown in funding for early-stage startups; in 2017, total funding numbers were ballooned by massive funding rounds from companies like Offerpad, WeWork, and Compass.

While total funding volume may have fallen this past quarter, large real estate firms are only increasing their investment in new technology. These firms have started to realize that tech products give them a competitive advantage, and there is an urgency to find the most promising startups, to form partnerships, and to test the efficacy of products in real time.

Rudin Ventures and Sterling VC, as well as venture units within Silverstein, Brookfield, Blackstone, Cushman Wakefield, LeFrak, Hines, CBRE, and other large firms, are currently seeking real estate venture investment opportunities (full disclosure: Dreamit UrbanTech partners with many of these firms and funds). CRE giant JLL just made its first acquisition through JLL Spark; the company acquired Stessa, a SAAS real estate technology company that allows income property investors to track, manage and communicate portfolio performance.

Key Stats for Q1 2018:

84 deals results in $1.4B in total funding. By month:

- January: $751M

- February: $192M

- March: $456M

Data from RE Tech

Largest PropTech Deals in Q1 2018:

- Ziroom (China): Warburg Pincus and Sequoia led a massive $621M fundraising round in this apartment rental platform. According to the WSJ, Beijing-based Ziroom leases apartments from individual owners, renovates the spaces and then subleases them to renters. It manages 500,000 rooms in nine Chinese cities, including Beijing, Shanghai and Shenzhen.

- PurpleBricks (UK): Axel Spring led a £125 million round in this post-IPO real estate brokerage. Purplebricks charges a flat fee rather than a percentage of the sale price and uses a mix of online and local agents.

- Cambridge Innovation Center (CIC)(Cambridge, MA): This coworking space provider raised $58M from European real estate investor HB Reavis. CIC campuses are primarily for startups, “corporate innovation spin-outs,” and VC funds, with tenants given access to desks, meeting rooms, labs, and other amenities. CIC's competitor WeWork has raised $7B in funding and is now valued at around $20B.

- NestAway (India): This home rental network raised $51M from Goldman Sachs and Ratan Tata. The company caters to the affordable rental housing market in India. The platform offers an option for renting without brokers' fees, and gives property manages a way to manage their property and collect rents.

- Apartment List (SF): Apartment List helps landlords find renters, and the startup differentiates itself from the many others in this space by charging only when a landlord has success in finding someone. The startup raised $50M from Passport Capital, Canaan Partners, and Industry Ventures.

- MIXER (Tel Aviv): This shared office space startup raised $40M from British investor Howard Shore, who joined the company as non-executive chairman. The proptech startup plans to use the capital to expand in Israel and to grow into New York and Berlin, two highly competitive markets.

- Qualia (SF): This real estate tech startup raised $33M from Menlo Ventures and Barry Sternlicht. The proptech startup streamlines the home closing process by bringing everyone involved (lenders, realtors, title agents, home buyers, sellers) into one platform. Already, 5% of the US real estate market is transacted through Qualia.

- Rentberry (SF): This rental platform's ICO (initial coin offering) became the industry's largest ever, resulting in over $20M in funding. The real estate company uses blockchain technology to connect tenants and landlords. Tenants leave reviews when they move out, and future renters can view these reviews on the site. In addition, Rentberry offers smart contracts for rental agreements and other documents.

- Roostify (SF): This proptech company provides digital lending solutions, speeds up the mortgage process, and eliminates paper-bound inefficiencies. The startup raised $25M from Cota Capital, Point 72 Ventures, and Santander Innoventures.

- LendInvest (UK): This marketplace platform for lending and investing is one of the UK's largest non-bank mortgage lenders. The company raised £16 million from Yogo Group.