The Next Phase of Real Estate Tech

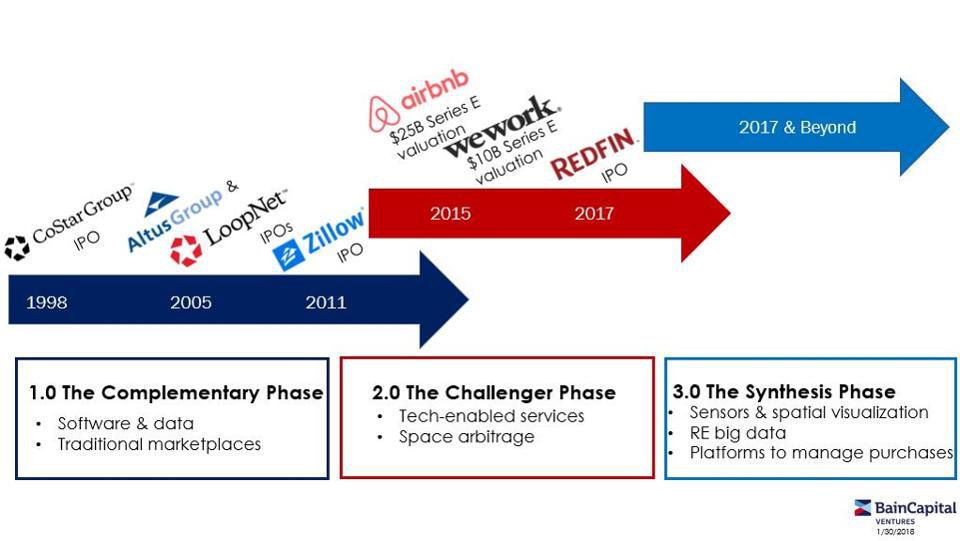

Over $5 billion was invested in real estate technology in 2017. The sector has strong momentum, and according to Matt Harris from Bain Capital Ventures, we are entering the third wave of real estate technology:

The businesses that define the emerging third phase of real estate technology are likely to look more like the earliest technology businesses in the space - more complementary than competitive to incumbents and deriving their value proposition by utilizing new technological capabilities. This phase likely will include companies that leverage sensors and virtual reality to create smarter spaces, machine learning to standardize and draw insights from industry data and platforms to more efficiently manage transaction services as well as to design, manage and outfit physical spaces.

The first phase was the complementary phase (tech being the complement to traditional real estate service providers). Tech companies like Autodesk and Yadi were established in the 1980s, and CoStar came along soon after. These services were closed-form enterprise services built to serve the commercial and residential real estate markets. Then, Zillow and Trulia became the dominant players in the home residential sector.

After the complementary phase came the "challenger phase," when tech-enabled services and space arbitrage entered the picture. The two biggest innovators in space arbitrage (creating more value out of space by changing its use or by enabling it to be used for different durations):

- Airbnb: a way for people to monetize their personal spaces

- WeWork: a way for developers and owners to monetize their commercial spaces

The companies in this phase are capital intensive and rely on network effects. In other words, they are likely not going anywhere. They are also a direct threat to incumbents (Airbnb to hotels; WeWork to office management companies like Regus). And the book is not yet closed on this phase. We have yet to see winners emerge in key subsectors of real estate, like property management and commercial brokerage (Reonomy is one company that could potentially own the CRE data space).

Now, we are likely entering a "synthesis phase" in which key startups will be complementary to the winners of the challenger phase (Airbnb, WeWork, Redfin, Compass, OpenDoor, Compass, etc.) The next wave of startups will create products to push forward these subsectors:

- IoT and Space Visualization

- Real Estate Big Data

- Platforms to manage service and purchasing

In other words, people will be increasingly informed about how they build, where they build, and how spaces are utilized. Machine learning will enable new entrants to use the data of incumbents in innovative ways. And startups will empower consumers to customize and reach a broad array of service providers through easy-to-use platforms that aggregate vendors.