Proptech Industry Matures, Seed Funding Slows

Trends in Seed Stage Venture Capital:

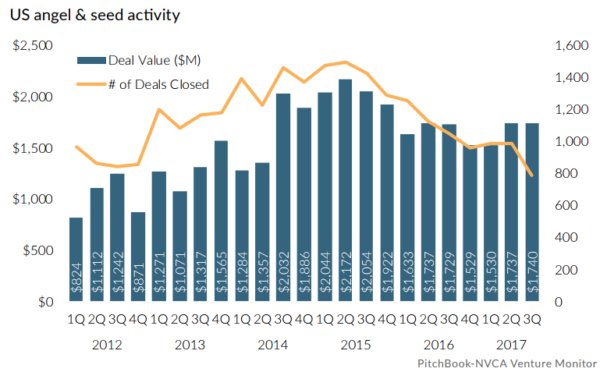

- Across all areas of venture capital, more capital is being invested in funding rounds than ever before, but the number of companies receiving investment has dropped. This suggests that fewer deals are getting funded at the seed stage and investors are focusing more on later rounds of funding.

Via Axios

- The number of angel investors in the United States is larger than ever, but it is becoming increasingly difficult for seed stage companies to raise funding. Angel investors are becoming much more selective. After a boom in angel investments over the past 3-5 years, many investors may be waiting for more liquidity, and some may have shifted investments to other asset classes after witnessing the difficulty of scaling a startup.

One reason this may be happening is that VCs are doubling down on “winner take all” leaders in their industries. According to TechCrunch:

Since 2014, aggregate funding into late-stage rounds has hovered around $55 billion a year, though it will be somewhat lower this year. Today’s $1 billion private financing round was unheard of a decade ago. Recent $1 billion raisers Airbnb, Spotify, WeWork and Lyft have joined previous billionaire raisers, including Uber, Facebook, SpaceX and Flipkart, and point to a strong trend to concentrate “winner take all” funding into companies that have real potential to lead or dominate their segment.

- Investors are grappling with the proliferation of seed stage startups. It has become increasingly difficult for investors to stay informed about hundreds of startups being created to solve issues across all industries. Investors have begun to focus on very particular sectors, reducing the flexibility of the capital currently being deployed.

- The public market boom does not appear to be driving much interest in seed stage deals or angel investing. As stocks have hit all-time highs and corporate profits have surged, angel investing at the seed stage has still slumped (but the number of corporate VCs has risen).

- More early-stage investors are putting their money into cryptocurrencies like Bitcoin, which have seen almost unbelievable returns, but this market has become much more volatile over the past week.

- Unicorns (private companies with $1B+ valuations) are staying private longer, reducing the number of engineers who spin out of these companies and launch their own startups upon IPO.

What's Happening in PropTech?

In the past four years, proptech startups have raised about $6.2 billion in funding worldwide, according to a recent report by Altus Group, an advisory services firm. In 2016, there was a record of nearly $2.7 billion invested in real estate tech companies, according to the Commercial Observer. Funding for real estate tech companies in the New York metro area climbed from $73.9 million in 2013 to $227.8 million in 2016, according to Dow Jones VentureSource.

These trends are fantastic, but they paint a rosy picture that does not tell the full story for seed stage startups.

- This slump in seed stage deals discussed above appears to be affecting proptech funding as well, as venture capital firms and traditional real estate development companies are putting more capital into mature companies raising Series B, Series C, and later rounds.

- The funding market has also become more competitive, as a number of accelerators, seed funds, and real estate family offices have shown an affinity for the proptech sector. For example, Brookfield Property Partners, Silverstein, and Rudin Management Company (via Rudin Ventures) are now investing in early stage proptech ventures. (Full Disclosure: Dreamit partners with many of these firms as part of its UrbanTech program.) These firms have generational assets that they can leverage to the benefit of the startups they invest in.

- According to the Observer, "the other reason why seed funding will be difficult to obtain is because today there are clear stars in the field, such as project management resource Honest Buildings, property management platform VTS and real estate investment firm Cadre. And most investors want to get on board with winning companies that will clearly become profitable, rather than take a chance with a smaller startup."

While seed funding has corrected, the New York proptech seen has never been better. Enthusiastic founders are solving real problems, and venture investors and family offices are collaborating like never before to find ways to bring these products to market. Our team, for one, has met with hundreds of founders this year alone, and we're excited to meet even more in 2018.